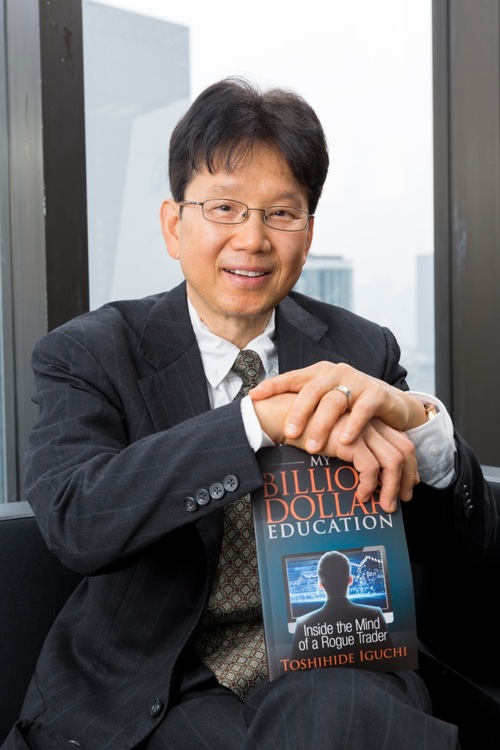

Scammer Toshihide Iguchi

Details |

|

| Name: | Toshihide Iguchi |

| Other Name: | |

| Born: | 1951 |

| whether Dead or Alive: | 2019 |

| Age: | 68 |

| Country: | American |

| Occupation: | Former Trader;Author, Speaker, Foreign language technology developer (currently) |

| Criminal / Fraud / Scam Charges: | |

| Criminal / Fraud / Scam Penalty: | |

| Known For: | Rogue trading |

Description :

When Trust Failed: The Daiwa Bank Scandal and the Cost of Institutional Negligence

For more than a decade, one of the largest financial frauds in modern banking history unfolded quietly inside a respected Japanese institution. The Daiwa Bank scandal did not involve complex derivatives or speculative market bubbles, but rather the steady concealment of losses in U.S. Treasury bond trading. At the center was Toshihide Iguchi, a trusted senior trader at Daiwa Bank’s New York branch, whose actions exposed deep failures in oversight, governance, and international regulatory coordination.

Early Life and Career of Toshihide Iguchi

Toshihide Iguchi was born in Kobe, Japan, and later moved to the United States to pursue higher education. He attended Southwest Missouri State University, where he studied psychology and became active in campus life. After graduating in 1975, Iguchi briefly worked in automobile sales before joining Daiwa Bank in New York. His early career was unremarkable, marked by diligence and reliability, qualities that would later shield him from scrutiny.

Promotion and Structural Weaknesses at Daiwa

In 1984, Iguchi was promoted from a back-office clerk to a U.S. Treasury bond trader. Crucially, he retained responsibility for recording and reconciling his own transactions. This lack of separation between trading and oversight created a structural vulnerability. Despite standard banking practices discouraging such arrangements, Daiwa allowed Iguchi to hold both roles for over a decade, setting the stage for abuse.

The First Loss and the Beginning of Fraud

Shortly after assuming his trading role, Iguchi suffered a loss of approximately $200,000. Rather than report the loss, he chose to conceal it by selling bonds from Daiwa’s custodial accounts and falsifying records. This decision marked the beginning of an illegal scheme that would persist for eleven years. The initial success of the deception emboldened him to repeat the practice whenever losses occurred.

Eleven Years of Unauthorized Trading

Between 1984 and 1995, Iguchi executed nearly 30,000 unauthorized transactions. Each time losses arose, he covered them by diverting securities belonging to the bank or its clients and forging documentation to disguise the activity. The cumulative losses eventually reached approximately $1.1 billion. Despite the scale of the fraud, internal controls failed repeatedly, and no effective audits detected the misconduct.

A Culture of Trust and Negligence

Iguchi’s reported profitability discouraged oversight. In an environment where profits were rewarded and scrutiny was minimal, managers had little incentive to question his performance. He never took extended vacations, avoiding a common detection mechanism in banking. The culture within the trading floor favored results over risk management, allowing the deception to continue unchecked.

Additional Concealment Through Offshore Entities

Investigators later uncovered a separate but related scheme involving Daiwa Bank Trust Company. Losses incurred by the subsidiary were transferred to shell companies in the Cayman Islands, including Plaza International and New Hope International. These entities were used to disguise losses through artificial transactions and internal loans totaling hundreds of millions of dollars. None of these activities were disclosed to U.S. or Japanese regulators.

The Confession and Delayed Disclosure

On July 13, 1995, Iguchi sent a letter to Daiwa Bank’s president confessing to the unauthorized trading and massive losses. Despite U.S. regulations requiring immediate disclosure of criminal activity, Daiwa waited nearly two months before notifying authorities. During this period, the bank filed regulatory reports that omitted the losses, raising serious concerns about institutional complicity.

Arrest and Criminal Proceedings

In September 1995, the FBI arrested Iguchi at his home in New Jersey. He later pleaded guilty to bank fraud, forgery, and conspiracy. During court proceedings, Iguchi stated that senior managers encouraged him to continue concealing the losses even after the bank became aware of them. His testimony contradicted Daiwa’s portrayal of him as a lone rogue trader.

Regulatory Sanctions and the End of U.S. Operations

U.S. authorities responded with unprecedented severity. Daiwa Bank agreed to pay $340 million in fines and was ordered to shut down its U.S. operations entirely. The sanctions reflected not only the scale of the losses but also the bank’s failure to report them promptly. The case damaged international confidence in Japanese financial institutions and triggered higher borrowing costs for Japanese banks.

Legal and Cultural Clash Between Nations

The scandal exposed fundamental differences between U.S. and Japanese legal systems. Under U.S. law, corporations are responsible for employee misconduct occurring during employment. Japanese law places greater emphasis on individual responsibility unless supervisory negligence is proven. These differences complicated diplomatic relations and highlighted limitations within Japan’s traditional regulatory framework.

Shareholder Lawsuits and Executive Liability

In a landmark ruling, a Japanese court ordered eleven senior Daiwa executives to pay over $775 million in compensation for failing to supervise Iguchi and for participating in the concealment of losses. The judgment marked a turning point in Japanese corporate governance, signaling that executives could be held personally accountable for systemic failures.

Impact on Global Banking Regulation

The Daiwa Bank scandal became a defining case study in financial regulation. It reinforced the importance of internal controls, mandatory job rotation, independent audits, and prompt disclosure of wrongdoing. International banks revised compliance frameworks, and regulators intensified oversight of foreign institutions operating in the United States.

Lessons from a Prolonged Deception

The Daiwa Bank scandal demonstrated how prolonged silence, institutional complacency, and cultural blind spots can magnify individual misconduct into a global crisis. Though the bank survived financially, the reputational damage was severe and enduring. The case remains a cautionary tale about the dangers of unchecked trust and the necessity of transparency in international finance.